Energy compliance services

Combined Heat and Power Quality Assurance (CHPQA)

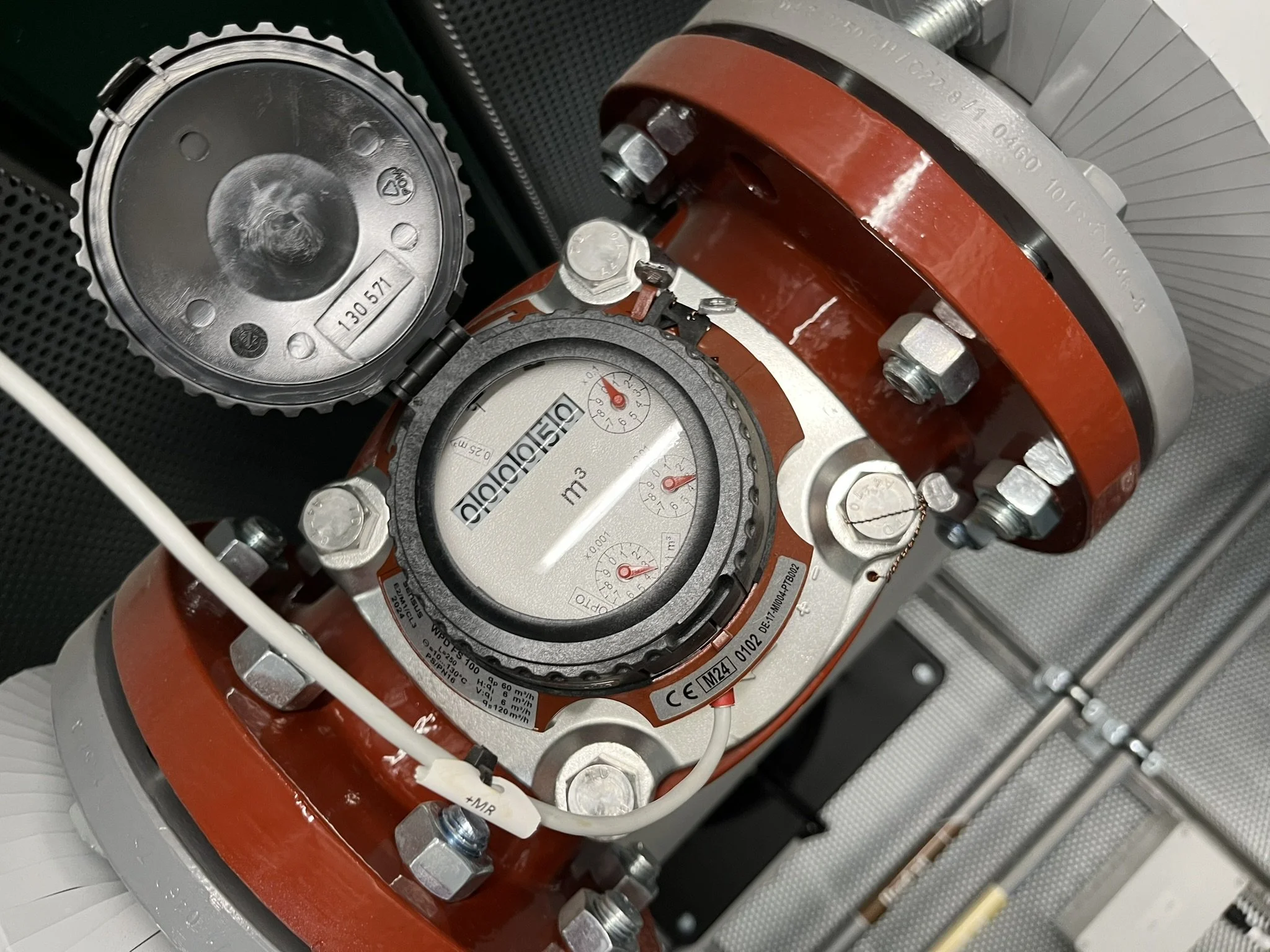

CHPQA (Combined Heat and Power Quality Assurance) is a UK government initiative that assesses the efficiency and environmental performance of CHP systems. It determines whether your system meets the government’s ‘Good Quality’ criteria, which focus on energy efficiency and carbon savings compared to generating heat and power separately.

Why does CHPQA matter?

Achieving CHPQA certification can unlock valuable financial incentives, including:

Reduced Climate Change Levy (CCL) rates

Enhanced Renewable Obligation Certificates (ROCs) or similar benefits

To maintain certification, operators must submit annual reports detailing fuel use, electricity generation, and heat output. We can manage this entire process for you, ensuring compliance and maximizing your benefits.

Climate Change Agreements (CCA)

A Climate Change Agreement (CCA) is a voluntary UK government scheme that helps energy-intensive industries improve energy efficiency and reduce carbon emissions. Only certain high-energy sectors are eligible to join.

Why join the CCA scheme?

Being part of a CCA gives you significant relief from the Climate Change Levy (CCL), resulting in substantial savings on your energy bills.

What are the requirements?

The scheme operates in two-year target periods, where businesses must record and report energy usage and meet sector-specific efficiency targets.

If targets are missed, a carbon buy-out fee applies at the end of the period.

There are also ongoing compliance tasks that can be complex and time-consuming.

We can manage the entire process for you - from application and compliance to securing your discounts - so you can focus on your business while we handle the details.

Climate Change Levy (CCL) Compliance

If you’re registered under the Climate Change Levy (CCL) scheme with HMRC, you are required to submit a CCL100 return for each reporting period. This applies to:

Energy Suppliers

Businesses supplying taxable energy (electricity, gas, LPG, solid fuels) to non-domestic customers.Self-Suppliers and Generators

Companies generating energy for their own use or for export, including those operating Combined Heat and Power (CHP) plants.Businesses Liable for Carbon Price Support (CPS)

Operators of certain generating stations who need to report CPS charges alongside CCL.

Submitting the CCL100 ensures you report and pay the correct levy on taxable energy supplies. Missing deadlines or errors can lead to penalties and interest.

We can take care of the entire process for you, ensuring your CCL100 returns are completed accurately and submitted on time. From gathering the required data to filing with HMRC, we make compliance simple and stress-free.

UK Emissions Trading Scheme (UKETS)

The UK ETS stands for the UK Emissions Trading Scheme. It’s a cap-and-trade system introduced in 2021 to replace the UK’s participation in the EU ETS after Brexit. The scheme sets a cap on total greenhouse gas emissions from certain sectors and issues allowances that businesses can trade.

Participation in the UK Emissions Trading Scheme (UK ETS) is generally mandatory for large emitters in the power generation, energy-intensive industries, and aviation sectors. The specific criteria that require a business to join the main scheme depend on the type of activity and the level of emissions produced.

Please get in contact if you are unsure of your eligibility criteria of if you need support complying with the scheme.

Renewable Heat Incentive (RHI)

The Renewable Heat Incentive (RHI) is a UK government scheme designed to encourage the use of renewable heat technologies by providing financial support to businesses, public sector organisations and households that generate heat from renewable sources.

Technologies covered:

Biomass boilers

Solar thermal panels

Ground-source and air-source heat pumps

Biogas and biomethane systems

The RHI scheme closed to new applicants in March 2022, but existing participants continue to receive payments for the duration of their agreement.

Participants receive quarterly payments over a set period (usually 7 years for domestic and 20 years for non-domestic) based on the amount of renewable heat generated.

If you are currently registered to RHI, we can support you with the ongoing submissions can compliance requirements.